Content

In very small businesses, a chart of accounts may be built with a three-digit numbering pattern. The best chart of accounts structure is the one that perfectly aligns with how your business operates and how you want to analyze it. Following best practices for high-level account numbering is a good starting point.

Should my chart of accounts have numbers?

Organize in Numerical System

Furthermore, a standard chart of accounts is organized according to a numerical system. Thus, each major category will begin with a certain number, and then the sub-categories within that major category will all begin with the same number.

If you’re using accounting software and want to set up a customized chart of accounts, you can add or edit parent and sub-accounts to the existing default chart of accounts. Doing this will help you stay organized and better understand how your business is doing financially. For example, if the software does not allow you to rearrange the order of the accounts on the financial statements, it becomes very critical how your order your chart of accounts. One of the advantages of a powerful chart of accounts is that it can prolong the useful life of even entry-level accounting software. Often frustration with financial reporting can be fixed by remodeling the chart of accounts, rather than going through the very painful process of migrating to new software.

Chart Of Accounts Numbering Best Practices

But it’s an important practice if you want to understand and improve your cash flow. Of crucial importance is that COAs are kept the same from year to year. Doing so ensures that accurate comparisons of the company’s finances can be made over time.

- Take your learning and productivity to the next level with our Premium Templates.

- Accounts are the specific “bins” that hold accounting transactions.

- Groups of numbers are assigned to each of the five main categories, while blank numbers are left at the end to allow for additional accounts to be added in the future.

Chart of accounts functionality is probably the most important attribute of accounting software and financial reporting. Entry level software with robust COA functionality can be made to work for many years. If the amount of the journal entry is mixed in with the regular wage expense accounts, it can be difficult to see how much of the wage expense relates to cash payments and how much is accrued. The same is true for complex journal entries that adjust work in progress (WIP) values, or over/under billings entries at companies that work with multi-month projects. For organizational elegance, keep numbers and descriptions consistent. Align direct cost account numbers with the corresponding sales account numbers.

Wait until the end of the fiscal year to delete old accounts

Account numbers may be structured to suit the needs of an organization, such as digit/s representing a division of the company, a department, the type of account, etc. The first digit might, for example, signify the type of account (asset, liability, etc.). In accounting software, using the account number may be a more rapid way to post to an account, and allows accounts to be presented in numeric order rather than alphabetic order. Small businesses use the COA to organize all the intricate details of their company finances into an accessible format.

The COA is typically set up to display information in the order that it appears in financial statements. That means that balance sheet accounts are listed first and are followed by accounts in the income statement. The exact numbering structure and ranges may vary depending on the size and complexity of the business, as well as the accounting software or system being used.

Account Identifiers

Each account in the chart of accounts is typically assigned a name and a unique number by which it can be identified. A company’s organization chart can serve as the outline for its accounting chart of accounts. Each department will have its own phone expense account, its own salaries expense, etc. A standard COA will be a numbered list of the accounts that fill out https://www.bookstime.com/articles/chart-of-accounts-numbering a company’s general ledger, acting as a filing system that categorizes a company’s accounts. It also helps with recording transactions and organizing them by the accounts they affect to help keep the finances organized. QuickBooks also has powerful reporting, which makes it easy to produce financial statements and other reports on your company’s financial health.

It’s worth setting up as many as relevant so you don’t have to go back and do it later. More commonly, a hierarchical code for a chart of accounts utilizes dashes instead of decimals. The uniform accounting code for a multimillion-dollar company would number division first, department second, and account last. Accounts are usually grouped into categories, such as assets, liabilities, equity, revenue and expenses. Chart of Accounts Numbering refers to the system of assigning unique numbers or codes to each account within a company’s Chart of Accounts.

But something like payroll for the support team is more complicated. With proper department tagging, you can reclass a portion of payroll from OpEx to cost of revenue to more accurately report margins. You could say 40% of support’s time goes to revenue-related tasks, whereas the other 60% belongs in OpEx because it’s related to more administrative work.

What is the best way to structure chart of accounts?

It's often easiest to structure the subcategories in a chart of accounts broadly along the same lines as the financial reports into which they feed. So balance sheet accounts follow the structure of the balance sheet, and income accounts follow the structure of the income statement.

My technology client had one big “room” for all Sales, with no bins and shelves. His month-end income statement could get no more detailed than that one account. At a glance, he had no idea which revenue streams were contributing to that bulk monthly number. The chart of accounts is like the framework of shelves and storage bins in a warehouse. Think of a computer hardware company that receives a constant stream of desktops, laptops, and printers. If their warehouse is well-organized, an arriving shipment of Dell laptops will be routed to a specific bin in the Dell section of the laptop area of the warehouse.

That is usually the number that computerized accounting programs use. Number each asset account in a sequence such as 1000, 1010, 1020, and so on, beginning with current assets and moving on to fixed assets. When you start a new business, you set up your chart of accounts as a first step in establishing your company’s accounting system. For example, if you have a service business, you won’t have an inventory account. A company’s accounting system relies on a framework of accounts that keep revenue, expenses, and other data organized and ready to put into a financial statement. Revenue accounts capture and record the incomes that the business earns from selling its products and services.

This acts as a company financial health report that is useful not only to business owner, but also investors and shareholders. A business transaction will fall into one of these categories, providing an easily understood breakdown of all financial transactions conducted during a specific accounting period. The FASB is an independent nonprofit organization responsible for establishing accounting and financial reporting standards for companies and nonprofit organizations in the United States. It has the authority to establish and interpret GAAP for all of these entities. You want to make it easy to compare the performance of different accounts over time. If you’re splicing, merging, and deleting accounts, that information can get lost and you’ll lose valuable financial data.

Say you have a checking account, a savings account, and a certificate of deposit (CD) at the same bank. When you log in to your account online, you’ll typically go to an overview page that shows the balance in each account. Similarly, if you use an online program that helps you manage all your accounts in one place, like Mint or Personal Capital, you’re looking at basically the same thing as a company’s COA. For example, to report the cost of goods sold a manufacturing business will have accounts for its various manufacturing costs whereas a retailer will have accounts for the purchase of its stock merchandise. Many industry associations publish recommended charts of accounts for their respective industries in order to establish a consistent standard of comparison among firms in their industry.

- In certain industries such as advertising, farming, or consulting, most of the costs run together under the broad category of operating expenses.

- Starting with a small number of accounts, as certain accounts acquired significant balances they would be split into smaller, more specific accounts.

- It is generally better to have less detail and keep it accurate than to have inordinate amounts of detail that tend to be inaccurate.

- In addition, you may customize your COA to your industry by adding to the Inventory, Revenue and Cost of Goods Sold sections to the sample chart of accounts.

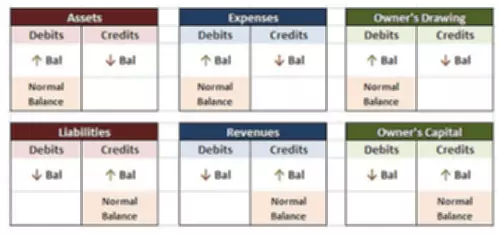

Assets, liabilities and equity accounts are used to generate the balance sheet, which conveys the business’s financial health at that point in time and whether or not it owes money. Balance sheet accounts are generally listed first on the chart of accounts. Expense and revenue accounts make up something called the income statement, which provides insight into a business’s profitability overtime. The remaining digits are used to create sub-accounts for each type of account. Accounting systems summarize sub-accounts at each higher level by combining account numbers to create the general ledger.

Number of Accounts Needed

To create a COA for your own business, you will want to begin with the assets, labeling them with their own unique number, starting with a 1 and putting all entries in list form. The balance sheet accounts (asset, liability, and equity) come first, followed by the income statement accounts (revenue and expense accounts). Five major account types in a chart of accounts are divided into balance sheet accounts and income statement accounts. While CoA can vary depending on the business, it will include assets, liabilities, equity, income/revenue, and expenses.

- Modern finance teams become strategic business partners by shifting from looking backward to looking forward.

- The general ledger is used by the accounting software to prepare financial statements and financial reports.

- For example, to track the cost of hardware purchased for resale, you might use account number COS-Hardware, which would align numerically with Sales-Hardware (child accounts would also align).

- It’s a filing system where you can see all of your transactions in one place, each stored under a relevant term.

- It’s common for organizations to structure their expense accounts by business function.

- You don’t need a separate account for every product you sell, and you don’t need a separate account for each utility.